How Much Money Do Insurance Agents Make?

One of the most common questions we get from students who enroll in our insurance exam prep courses is, “How much money do insurance agents make?”

It’s a reasonable inquiry. After all, you need to know how much you can expect to earn when deciding whether to pursue a career as an insurance agent.

The good news is that most insurance agents can expect to make well above the national median income of $31,133 (all industries, as of 2019).

How Do Wages for Insurance Agents Compare to the Average?

According to the most recent data from the Bureau of Labor Statistics (BLS), the median income for insurance sales agents (all types) in the US is $49,840 per year, or $23.96 per hour. This is 37% more than the national median income ($31,133) for workers in all other industries.

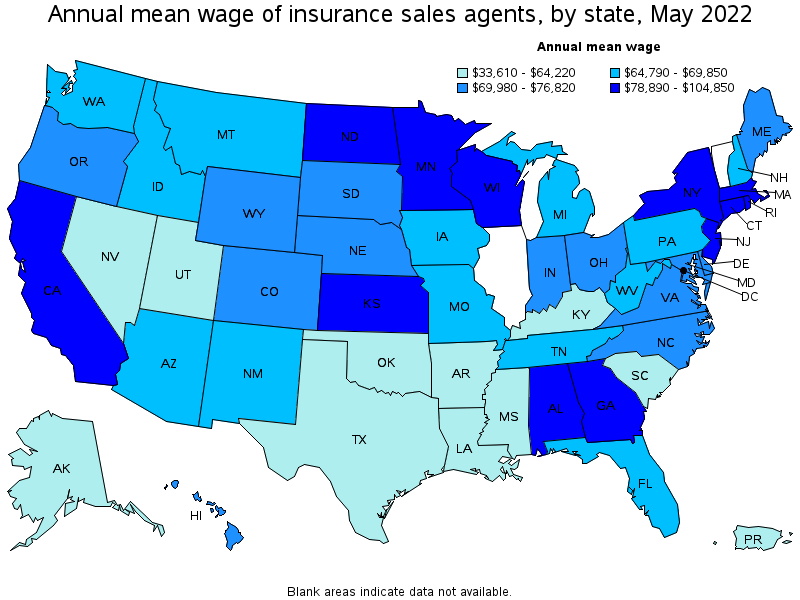

According to the BLS, the top paying states/cities for insurance sales agents (mean wages) in 2021 were:

- District of Columbia: $100,050/year, or $48.10/hour

- New York: $93,610/year, or $45.01/hour

- Massachusetts: $ 90,160/year, or $43.34/hour

- Georgia: $83,760/year, or $40.27/hour

- New Jersey: $81,640/year, $39.25/hour

Source: https://www.bls.gov/oes/current/oes413021.htm#st

Factors That Influence How Much You Earn

The amount of money you can expect to earn as an insurance agent varies widely based on several factors, including:

- The state where you sell insurance

- Which products you sell (life, health, auto, homeowners, etc.)

- Whether you work as a captive agent or independent agent

- Your sales numbers (how many policies you sell per month/year)

- The price of the plans you sell (insurance sales are commission-based)

- How many years of experience you have (more experienced agents tend to earn more)

Even which part of the state you live in can impact your salary. A Life insurance agent who lives in New York City, for example, can expect to earn more than a Life insurance agent in Albany or Buffalo. In general, agents who live in large cities where the cost of living is high will command higher salaries/hourly rates.

So, how much do life insurance agents make? And how much do health insurance agents make?

We’ve done our best to answer these questions below by looking at the latest salary data for Life agents, Health agents, Life & Health (L&H) agents, and Property & Casualty (P&C) agents, both nationally and in select states across the US.

How Much Do Property & Casualty (P&C) Agents Make?

Property and Casualty (P&C) agents sell products like auto insurance, property insurance (homeowners, renters, condo insurance, etc.), flood protection, workers’ compensation, commercial auto coverage, umbrella insurance, and more.

As of early 2023, the average annual pay for a Property and Casualty insurance agent in the United States was $49,936 a year.

Here is the average amount P&C agents earn in these select states:

| State | Annual Salary | Hourly Wage |

| Hawaii | $53,160 | $25.56 |

| Washington | $51,527 | $24.77 |

| Arizona | $51,314 | $24.67 |

| Wyoming | $51,289 | $24.66 |

| Montana | $49,005 | $23.56 |

| Iowa | $47,673 | $22.92 |

| Utah | $46,842 | $22.52 |

| Idaho | $46,066 | $22.15 |

| Missouri | $45,316 | $21.79 |

| Kansas | $45,235 | $21.75 |

| Virginia | $44,873 | $21.57 |

| Georgia | $41,121 | $19.77 |

| Texas | $39,981 | $19.22 |

| South Carolina | $38,915 | $18.71 |

The top 10 paying states for P&C agents are New York, New Hampshire, Vermont, Arizona, Wyoming, Hawaii, Tennessee, Massachusetts, Nevada, and New Jersey. P&C agents in these states earn higher salaries than the national average.

Looking for the BEST courses available to pass your insurance license exam?

How Much Do Life & Health (L&H) Agents Make?

As the name suggests, Life & Health agents are licensed to sell both Life insurance policies (and annuities) and Health insurance policies.

As of early 2023, the average annual pay for a Life & Health insurance agent in the United States was $80,070 a year.

Here is the average amount L&H agents earn in these select states:

| State | Annual Salary | Hourly Wage |

| South Carolina | $109,000 | $52.40 |

| Utah | $100,000 | $48.08 |

| Georgia | $85,000 | $40.87 |

| Missouri | $57,500 | $27.64 |

| Texas | $55,000 | $26.44 |

| Virginia | $43,875 | $21.09 |

How Much Do Life Insurance Agents Make?

As of early 2023, the average annual pay for a Life insurance agent in the United States was $83,442 a year.

Here is the average salary for Life insurance agents in a few select states:

| State | Annual Salary | Hourly Wage |

| Hawaii | $77,182 | $37.11 |

| Washington | $75,612 | $36.35 |

| Arizona | $82,120 | $39.48 |

| Wyoming | $81,898 | $39.37 |

| Montana | $78,424 | $37.70 |

| Iowa | $68,704 | $33.03 |

| Utah | $67,389 | $32.40 |

| Idaho | $67,650 | $32.52 |

| Missouri | $66,226 | $31.84 |

| Kansas | $65,562 | $31.52 |

| Virginia | $74,054 | $35.60 |

| Georgia | $65,809 | $31.64 |

| Texas | $66,215 | $31.83 |

| South Carolina | $56,861 | $27.34 |

The top four paying states for Life insurance agents are New York, New Hampshire, Vermont, and Maine. Life agents in these states earn higher salaries than the national average.

How Much Do Health Insurance Agents Make?

As of early 2023, the average annual pay for a Health insurance agent in the United States was $57,930 a year.

Here is the average salary for Health insurance agents in a few select states:

| State | Annual Salary | Hourly Wage |

| Hawaii | $55,089 | $26.49 |

| Washington | $63,894 | $30.72 |

| Arizona | $54,378 | $26.14 |

| Wyoming | $54,091 | $26.01 |

| Montana | $51,931 | $24.97 |

| Iowa | $48,639 | $23.38 |

| Utah | $47,615 | $22.89 |

| Idaho | $56,537 | $27.18 |

| Missouri | $47,608 | $22.89 |

| Kansas | $46,707 | $22.46 |

| Virginia | $50,737 | $24.39 |

| Georgia | $43,577 | $20.95 |

| Texas | $52,917 | $25.44 |

| South Carolina | $40,866 | $19.65 |

The top four paying states for Health insurance agents are Washington, New York, Idaho, and California. Health insurance agents in these states earn higher salaries than the national average.

More Good News for Insurance Agents

As we’ve outlined above, wages for insurance agents can vary widely based on the type of insurance agent, which products they sell, where they live, and several other factors. But, it’s clear from the data that insurance agents can expect to earn a comfortable living, especially as they gain experience.

More good news: The insurance industry is only expected to grow in the coming decade. The Bureau of Labor Statistics projects 6% job growth for insurance agents between 2021 and 2031.

America’s population is aging. This is increasing the demand for products like Life and Health insurance. Additionally, federal regulations like the Affordable Care Act are generating higher demand for insurance among consumers.

Study for Your Insurance Licensing Exam with America’s Professor

Things are looking good for insurance agents across the US. If you’re ready to launch a lucrative and stable career as an insurance agent, your first step is to get licensed.

America’s Professor is a trusted national provider of top-quality insurance pre-licensing education. We offer comprehensive online exam prep courses to help prepare you for your state licensing exam.

AP courses are taught by industry professionals with decades of combined experience in the field.

Ready to start your new career? See what our students are saying about AP and enroll in a course today! Or get in touch with us to learn more by calling 1-800-870-3130.

Sources:

- https://datacommons.org/place/country/USA?utm_medium=explore&mprop=income&popt=Person&cpv=age,Years15Onwards&hl=en

- https://www.bls.gov/ooh/sales/insurance-sales-agents.htm#tab-1

- https://www.bls.gov/oes/current/oes413021.htm#st

- https://www.ziprecruiter.com/Salaries/LIFE-Insurance-Agent-Salary

- https://www.ziprecruiter.com/Salaries/What-Is-the-Average-LIFE-Insurance-Agent-Salary-by-State

- https://www.ziprecruiter.com/Salaries/Health-Insurance-Agent-Salary

- https://www.ziprecruiter.com/Salaries/What-Is-the-Average-Health-Insurance-Agent-Salary-by-State

- https://www.ziprecruiter.com/Salaries/Life-Health-Insurance-Agent-Salary

- https://www.ziprecruiter.com/Salaries/Life-Health-Insurance-Agent-Salary

- https://www.ziprecruiter.com/Salaries/Property-And-Casualty-Insurance-Agent-Salary

- https://www.ziprecruiter.com/Salaries/What-Is-the-Average-Property-And-Casualty-Insurance-Agent-Salary-by-State

|

|

| Insurance Licensing Courses | Insurance Practice Exams |

I am an life insurance producer. It is very possible to make $400,000. Definitely need to continue getting educated on obtaining different licenses to work up to the high paying commission products. You left out annuities… Retirement planning is the way to go… Rollover 401K , 403b, CD’s, company retirement IRA’s etc.. It’s a no brainer. Love my job! People are very grateful for our help..

Hi Jeannie, Thank you for your input. It’s always nice hearing from the Pros! 😉

This is awesome to hear I’m studying now to get my license. I look forward to taking on this career.

Do you know why new agent give up because they have a huge advertising bills min $700.00 per week and you lose 20% of your business because people cancel there policy for a cheaper price that they find and people get depressed and leave the field. And you will be working 7 days a week 13+ hours a day. If you still want to be a agent just have a lot of money to fall back on and the job you are considered a contractor and need to spend money on a accountant to set up your business.

All great points to think about!

Just getting started and would love to get to the 400k per year! Would like more info!!!!

Hi Jeannie,

I’m contemplating on joining and I live in Ohio but currently researching as much as I can. If you don’t mind me asking were u experienced and how do you obtain your customers?

Hi Jeannie, I am new to the insurance field. I am a Florida resident with my 2-15 license. Recently hired my Everise to sell Medicare products at an hourly rate. I would love to connect with you to pick your brain on how I can make this a fruitful career. I am also a real estate broker making 6-figures in sales annually. However we have dreams of traveling more than we do, and so I am transitioning into insurance sales to be able to work from anywhere. Any feedback is appreciated. Thanks so much!

The insurance industry is very lucrative. If you are creative and have a team of producers working in the field with you, you can definitely earn $400,000 a year or more. It is not uncommon for our first year reps to earn over $125,000 as a sole producer. The stats on the internet showing incomes of $26,000 are very misleading. This is through static insurance systems that purposely control and restrict your income. Independent reps with appointments to multiple insurance company’s can earn a exceptionally good living. Yes, it is more then possible to earn 400k annually in the insurance… Read more »

is that AFTER advertising expenses, etc

Very informative! Thank you. I’ve spent the past 20 years in the military and have decided to retire and do something different that seems exciting. I was recently hired on by Equis Financial and I’m currently studying to attain my insurance license. I have some experience in recruiting and sales so I’m hoping that I can harmonize that experience with the knowledge I gain in the insurance industry and become successful. Many people have told me that with tenacity and charisma, this industry can be very lucrative.

Hi Bruce,

Can you please give more information about this “Independent reps with appointments to multiple insurance company’s can earn a exceptionally good living”

Best,

I am insurance broker for 22 years and can help you to get appointed with multiple companies. email to me tatianager@yahoo.com

I make about $285 to $340K per year, but I also have a securities license. I make about $200 K at the get go due to renewal commissions. Get into the senior market, ie medd supp and Medicare adv plans. They are so confused out there. Im basically the only game in town. I work 8:00 to 3:00 now. But, I paid my dues. Started captive but now have had my own agency past 20 years. PC lic but I do none of that.

Thanks for the information Todd! It’s nice for folks to get a bit of perspective and advice.

Question Todd, So I have my Personal lines License , to be a big game hunter in this field. What license would you recommend ?? P&C ? I’m told Life Insurance is bad to go into since Obamacare but please lol any advice I will take!

I am insurance broker for 22 years and can help you to get appointed with multiple companies. email to me tatianager@yahoo.com

Hi Todd, I am just now working on getting my life and health insurance license. I am in my early 50’s and I had to change careers due to a layoff at my job. I live in Colorado but I am planning on moving to Florida next year. Do you have any suggestions that could help me get new clients and that would help me boost myself into the 100k to 200k per year income? Thank you!

I am insurance broker for 22 years and can help you to get appointed with multiple companies. email to me tatianager@yahoo.com

I have been in the insurance field for over 30 years. Early on, I started my own own agency and began building a block of small business clients, starting first with health insurance, than adding group Life, Disability and other lines. Most of my individual clients have come from the group plans. I built a service agency—-none of the 6 employees that still work with me over many years, are sales people—all are salaried service who share my passion for providing the highest level of service. I believe the most important secrets of success in our industry are: 1. Don’t… Read more »

Well said Brian!

I am in insurance industry for 22 years and know this industry very well. If you build your book of business and have multiple companies to serve your clients needs, than you can move much faster. If you have good mentors who teach you not only product side, but a business side you will move much quicker. Every successful business take time and effort to build. I love this business because no overhead, and I can run my business from any part of the world. Tatiana Gerberg

Hi Tatiana! I am new to the insurance field. I am a Florida resident with my 2-15 license. Recently hired my Everise to sell Medicare products at an hourly rate. I would love to connect with you to pick your brain on how I can make this a fruitful career. I am also a real estate broker making 6-figures in sales annually. However we have dreams of traveling more than we do, and so I am transitioning into insurance sales to be able to work from anywhere. Any feedback is appreciated. Thanks so much!

Hi Tatiana, I have specific questions for you. Would you email me. I have entered my info below. Thank you!

Sounds exciting – don’t pros with 22 years of experience have a website with branded email instead of a FREE Yahoo address???

Hi Elroy, It’s interesting how often we see, and say, the same thing…

Sounds great. Send me info on how to get started Thank you

[…] a motivating factor for some of those looking to gain a job in the insurance industry. The insurance agent salary of the highest 75 percentile rang in at about $73,650, while the lowest 25 percentile came in at […]

I am an insurance producer now and I only receive about 50% of the premium for each policy. But I am wondering is this typical? I am new to this job and get frustrated because I am wondering how someone could even live off of this? I have not seen a paycheck yet and have been doing a lot of foot work and traveling and wondering is this even worth it? please any advice is helpful

Hi Tanya, maybe try approaching your employer and ask if you could be moved to a salary for the first year while you build a book of business. Different employers have different compensation methods like salary only, commission only or a mix of the two. You would have to ask around to see what commission sharing is common with other insurers as this is something we aren’t familiar with. Good luck!

I just close my 2nd biggest sales today, I’m super motivated that I wanted to share how much I will be making. 5 million IUL pay $79,000 commission. Wow

Indeed, there is some great money in those huge policies!

Hi I’m Charles I’m 21 and looking to get into insurance but I am scared of commission. I cant go in and not make much the company that wants me is American income life any advuce?

Hi Charles, Different companies have different compensation models. If you want to find a company with a salary option, or part salary and commission, I suggest you research more companies as an option. Each one varies a bit I’m sure. There are a lot of people who are in your same position! Good luck!

I am looking to get into this program. My only concern is my background. I would like to eventually get my license but am I able to do so even though my background is not clear? It’s not like I did terrible crimes but I just wouldn’t want this to hold me back and I’d like to peruse this. Thanks in advance !

Hi Crystal, You can usually get pre-qualified through your state’s insurance licensing department to make sure you don’t go through the process of passing the exam only to find out that you don’t qualify for a license. That’s where I would start. Good luck!

Hi, I know it’s late but have you started studying for your license yet? If you are really worried about your background hire a licensing lawyer BEFORE you apply for your license. They will help you with the application process

Interesting approach but that sounds kind of costly. If you’ve had experience with it, how did that process go? Most licensing departments allow you to go through and get “pre-checked” without much cost.

Crystal, They check for felonies and for crimes involving theft or money. They don’t care about traffic tickets. They will ask about misdemeanors. You simply have to send in a copy of the court case, show you paid your fine etc. Again, the misdemeanor needs to be a simple one, like dog at large.

Hello, my name is Janelle. I am very interested in selling insurance but, I’m unsure of which license to get first. I was leaning towards health and life. Mainly, because, I have worked in the medical field for 5+ years but want a step in a new direction career wise. After doing some research, I am now leaning towards property and causality. I have read it is better for beginners. Any insight? Thank you in advanced!

Hi Janelle, We see a high percentage of our students get their Property and Casualty (PC) license first, then Life and Health (LH). I believe it’s because most companies want them to sell PC first. Since Home and Auto insurance is required by law it also makes it an easier sell when first getting started as a new Producer. Then once you have a client base it’s easier to have the conversation about Life and Health products. But if you found a company you wanted to work for and they wanted you to be LH licensed first, obviously you would… Read more »

We are always hiring

I was curious because on a Dave Ramsey radio show, a caller came in saying she was an insurance. And she made $400,000.00 per year. She didn’t go into more details than that. I was wondering what kind of insurance agent makes that lind of money?????

Hi Barbara, She probably has a very large book of business! There are a lot of different types of agents/producers she could be. She could have a lot of Property and Casualty commercial policies or possibly she sells a lot of Medicare supplements. There are many different areas of insurance that you can make good money!

How do you go about obtaining the licensure for casualty and property?

Hi April, Usually you take a pre-licensing course to prepare for the exam, sign up and take the licensing exam (pass!), go through a background check and apply for your license with the state. Give us a call if you have any other questions. Thanks!

Which is more lucrative, personal insurance or commercial?

Hi Fred, I guess it just depends on who you talk to but from a licensing stand point you might as well get a full Property and Casualty license (Personal + Commercial) so you don’t have to look back at the pre-licensing process in the future. Commercial accounts usually pay really well but they don’t tend to come along as often as personal accounts do for most producers. Usually us see a bit of diversification with both types of policies being sold.

Im studying for CIC license and sponsored by a reputable local Agency to sell Commercial P&C insurance. They offer base salary, $50% Commission on all New business with 30% residual income.(That’s where income grows). Key is to partner with a reputable insurance Agency/group. Like everything else, if you are expecting to make $$ easily you WILL fail.

how can I become an insurance agent

Hello Pedro, You’ll first want to look at the requirements in your state (see your state’s Department of Insurance – Agent licensing section). Usually you will take a pre-licensing course and then pass your insurance exam. After applying for, and receiving, your license you are ready to go to work for an insurance agency. Please give us a call if you have any questions. Good luck!

I’m considering getting my 215 license, would this be a good starter license? I’ve been working in retail for 30 years and need a change. Is it too late for me to get started at almost 50? Please lead in in the right direction.

Thank You!

Hello Debra, It’s never too late to get started in insurance! What state are you in? When you say 2-15 are you referring to a Life and Health license in Florida? If you’d like to like to give us a call it might be easier. Thanks!

Where do you recommend for study guide or for class to be certify insurance agent

Hello Getachew, It depends on your location and learning type. If you are in one of the states we operate in and do well with online courses then we recommend our courses. 🙂 If you have any other questions please give us a call. Have a great day!

How much money do insurance agents make? I am just curious because I am a licensed chiropractor wanting to be an insurance agent. I was doing some research on it but couldn’t find out how much they make a year. Sorry to bother!

Hi Zach, If you refer to the number above, it looks like the median income is $48,150 a year for Insurance Producers. If you also read the submissions here a few others have weighed in with their success too. Good luck!

I am interested in Property & Casualty License in South Carolina, Just relocated from FLA DO I need to have a sc drivers license right now for paperwork in regard to testing and fingerprints etc?

Hello Victoria, From a testing perspective they will use your two forms of photo ID to verify your name (and who you are) but not your address. From a licensing perspective you might run into an issue though with residency requirements. You should call the Department of Insurance in South Carolina (803-737-6160) and chat with Licensing to see what their policy is on that. Good luck!

As a independent 215 licensed agent, can you be appointed with more then one company? Please advise. Thank you!

Hi Margie, If you are an independent agent you should be able to work with more than one company unless you’ve signed an employment contract that states otherwise. Good luck!

Is the P&C license sufficient to pursue an underwriting position?

Hi Betty, It wouldn’t hurt you because it would include some risk management teaching.

I’ve read that you need to buy “leads”? Meaning info of potential clients.

Hi Caro, I’m sure a few others will want to chime in here but it probably depends on the company you are going to work for and their level of support for you. I think in general you will have to find an ongoing source of new leads, whether that means buying leads or getting them via your company/other sources. Hopefully at some point you are doing so well that you get all the customer referrals you need from your prior and existing customers! Good luck!

As an independent agent, which broker(s) pays the highest comission for car insurance?

Hi Tony, Unfortunately we don’t know the numbers here. Maybe someone else might chime in but I’d recommend looking over at insurance-forums.com to see if someone has already answered your specific question. Good luck!

Is it common for healthcare providers to get involved in insurance sales on the side? Health insurance or Medicare supplements?

Hi Stephen, Some do but I’m not sure how common it is. It just depends on their marketing structure. Good luck!

Hello, I’m 21 and have just obtained my associate’s degree and I’m now working towards my bachelors in business. Will this give me an advantage when looking for an agency to work with and if the position offers salary could I potentially make more starting off due to my background? I’m looking into jump starting my career before graduation. Can I be a full time student and still make money working part time as an insurance sales agent? Any advice?

Hi Brittany, Many insurance jobs don’t require a degree but some do. In my experience, selling insurance is a full time job and not something I would try to do as a full time student. Others may chime in here but I’m thinking you’d be best off to finish school before starting an insurance job. It never hurts to start having that conversation early though with a potential employer. Good luck!

What you make, Or the numbers written on your offer letter, Or the name over the building you enter might differ from between a $ for millions a year.

Yet “Once” you water all the BS down, millions of past , current and future employees will struggle to make rent and living expenses.

I have my accident, health, life license. So far, I have only used my life license for life products. However, I am interested in doing all three. My goal is to increase my income 100%. Then eventually obtain my investments license.

would anyone agree that selling insurance would make a great side hustle?

Does it also depend on the kind of insurance? personal, business, etc? Thanks for taking the time to share this information. Very interesting.

Good Afternoon and Happy and Safe New Year to all. I am NOT looking to become an insurance agent, however, I am interested in learning about Insurance. I am a retired federal employee and veteran. I have insurance policies that were offered during employment and carried over to retirement. there is a $50K Whole Life policy for my wife and she also is on Medicare (in addition to my BC/BS policy carried into my retirement. Here are the types of insurance that I have: Term Life for me. Whole Life for wife. Homeowners, Auto, BC/BS, Medicare (part B) for wife,… Read more »

Hi Mike, Thanks for your email but most of what we do is all in “Test World” which tends to be slower to change than “Real World”. Unfortunately, I don’t really know of a great place to send you. Good luck!

Hi Mike. Are you interested in learning about insurance in order to understand your portfolio and make decisions? Totally understandable. I’m a Retirement Income Specialist and I’ll share with you (on average) what you can expect to get educated. Leaning Medicare is an on-going, involved process, but expect to devote about 4-5 months understanding the basics. It’s a very compliance-heavy product so be very cautious yet focused when making changes in your benefits. Give yourself about 3 months to learn about Annuities and your retirement package. Devote roughly 1-2 months learning about life insurance policies and what would best fit… Read more »

What’s the difference between schools? I’m asking cause here Florida check school that charge $600 and other charge $1.200 for same license 2-20.

Hi Jonathan, There are many different ways to learn information. In some states they sell a course PDF and no support for very little while other schools provide physical materials and great customer support for more. You need to compare their offering and figure out what’s best for you. I know failing the exam gets costly (both in time, money and opportunity costs) so for me I would try to pick a school that had a teach style that worked with my learning style and that also had a high pass rate and great reviews. Good luck!

how much of a commission does my farmers insurance agent make on my home and auto policies which total $5,848 per year

Hello Nick, Thank you for your question but that’s a little beyond our knowledge. We work will a lot of different agencies but none of them usually get that specific as I believe it changes from year-to-year and is also based on the type of policy. Maybe someone else reading this post will share some incite.

I’m a life agent too don’t forget about the lost business when costumers cancel there policy you loose your a$$. Let’s talk real numbers 20% lost business every year that number. Here is the thing if you are not a very good underwriter and price the customer policy correctly it is going to be replaced because everyone is looking to save more money and constantly have insurance companies calling them to sell insurance. This is a bad occupation and you will work 7 days a week and spend unbelievable amount of money on advertising to make good money.

Yeah selling insurance isn’t for everyone, that’s for sure. We talk to people on both sides of the isle. Often they say diversifying the policies you sell helps and eventually you will find your niche… or switch to something else. One thing is for certain, it can take a lot of energy and resources upfront for this occupation to be a fruitful lifelong career.