How to Get Your Georgia Insurance License

Looking for the BEST Georgia course available to pass your insurance license exam?

There’s no better time to become an insurance agent in Georgia

Georgia is a great place to work as an insurance agent. The cost of living is low compared to other states, yet the demand for insurance is high.

Georgia’s rapidly growing residential construction industry means more people than ever need homeowners insurance, while the state’s growing senior population is increasing the demand for life and health insurance products.

Meanwhile, Georgia’s growing cybersecurity and health information technology industries are attracting workers from all over the country—and those workers need multiple insurance products. Competition within the state’s insurance industry has grow to be extremely fierce, and with more people trying to work as insurance agents in the Empire State of the South, you should invest in the Georgia insurance license exam course work by America’s Professor to help improve your chance to pass the test on your first attempt and to enable you to start out of the gate running.

Some of the nation’s biggest insurance carriers have offices in Georgia’s city centers like Atlanta, Augusta, and Columbus. These are great places to live and work, but there are plenty of opportunities in smaller communities throughout the state, too.

The job market is booming for insurance agents, and there’s never been a better time to get your Georgia insurance license. Here are the basic steps to getting licensed.

Step 1: Decide Which Georgia Insurance License Type You Need

Your first step is to determine which license(s) you need. Most new agents get either a Property & Casualty (P&C) or a Life & Health (L&H) insurance license.

With a P&C license you can sell products like auto and homeowners insurance. With a L&H license you can sell products like life insurance, annuities, and health insurance.

Most people start out by selling a single line of authority and gradually expand into new areas.

Step 2: Invest in a Georgia Insurance Pre-Licensing Course

After you’ve determined which license you’ll get, your next step is to enroll in a pre-licensing education course. Georgia’s Office of Insurance requires proof that you’ve completed pre-licensing education before you can take the insurance exam.

Here are the pre-licensing education hour requirements in Georgia:

| Line | Hours |

| Life | 20 |

| Accident & Sickness | 20 |

| Life, Accident & Sickness | 40 |

| Property | 20 |

| Casualty | 20 |

| Property & Casualty | 40 |

| Personal Lines | 20 |

| Variable Products | 8 |

| Navigator | 10 |

Most people take an online course, which offers more flexibility than in-person courses. Streaming courses give you the freedom to study on your own time and at your own pace.

America’s Professor offers a range of state-approved online pre-licensing courses to help you pass your exam on the first try. Our comprehensive study solutions are designed to help you easily absorb complex insurance concepts and terminology. We’ve developed our material to complement every learning style, whether you’re a visual or auditory learner—it’s why our pass rates are among the highest in the industry. Find your course and sign up today.

Step 3: Register for Your Georgia Insurance License Exam

Once you’ve passed your pre-licensing course you can register for your insurance licensing exam.

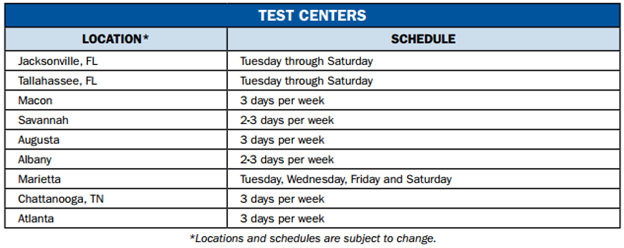

Pearson VUE is the company that administers insurance licensing exams in Georgia. You should register for your exam 3-7 days in advance to ensure you get the test date and time you want.

There are several in-person test centers in and around Georgia, shown below.*

*Check Pearson Vue’s COVID-19 Updates page for up-to-date information about in-person testing.

Step 4: Pass the Georgia Insurance License Exam

Most Georgia exams have around 100 questions, and each exam contains both a “national” and a “state rules” section. You must score 70% or higher on both parts to pass—the two scores are not averaged together.

For example, the Georgia Property & Casualty exam has 100 questions. The breakdown is 70 questions on national/general content and 10 questions on Georgia state-specific content, plus 20 pretest questions. Pretest questions are not scored, and they’re designed to throw you off. If you see questions on the exam that look unfamiliar or confusing even though you’ve studied hard, don’t panic—these are likely pretest questions.

Your exam will be scored on the spot, and you will not be told which questions you got right or wrong. Instead, you will just receive your total score.

The exam fee is $63 for each attempt. Note that if you fail the exam, there is a 2-week waiting period before you can retake the test. If you fail 3 times, you will be required to retake your pre-licensing education course through a different provider before you can attempt to take the exam a fourth time.

Step 5: Fingerprinting and Background Check

You must provide fingerprints and agree to a background check to apply for your license. If you have any prior misdemeanors or felonies, it may impact whether you can get your insurance license. Contact the Georgia Office of Insurance for more information.

The fee for fingerprinting services is $53. Gemalto is the approved fingerprinting vendor chosen by the Georgia Office of Insurance. You will receive a fingerprinting card during your appointment. Hold on to this, as you’ll need it when you apply for your license.

You’ll also need to fill out a citizenship affidavit and save it as a PDF. You will provide this affidavit when you apply for your license.

Step 6: Apply for Your License

Your next step is to apply for your license through Sircon. First, you will need to register for an account.

You will need to provide:

- Proof you passed your exam

- Fingerprint card

- Citizenship affidavit

You will have a chance to upload these items during the online application process.

It usually takes around 14 days to receive your license after your application is reviewed and approved.

Once you’ve received it, you can start looking for work. Or, if you’re already employed, you can start selling or discussing insurance right away!

Want to Pass the Georgia License Insurance Exam on Your First Attempt? Sign Up for an America’s Professor Course

For more than three decades America’s Professor has helped students all over the country prepare for their Georgia insurance licensing exams. Our affordable online classes are taught by award-winning professor Dr. Jack Morton. His approachable teaching style makes the material easy to understand, and he uses real-world examples and amusing stories to keep you engaged. When students use the pre-licensing course work as it was intended, they have more than a 90 percent chance of passing the Georgia insurance license exam on their first effort, which is important for jump-starting one’s career.

Each AP course includes:

- Video lessons – Our comprehensive online insurance courses are available 24/7 on any device. Our streaming videos simulate live lectures but let you study at the pace that’s right for you.

- Hard copy textbook – You’ll receive a comprehensive textbook by mail, which works in conjunction with the lecture videos.

- 100-day online access – Most students find that 100 days is plenty of time to prepare. But if you need more time, simply call us and we will extend your access at no charge until you pass your exam.

- Sample questions and practice exams – Practice tests reinforce the information in the video lectures and help you gauge how well you understand the material. If you score low on a practice exam, you’ll know where you need to keep studying.

- Customer support – Our helpful customer support team is here to answer all your questions and make sure you have everything you need—right up until the day of your exam.

Enroll in a course today and be on your way to launching or expanding your career in the lucrative insurance industry!